IRS Stimulus Checks 2025: What's Fact, What's Fiction?

No, the $2000 Stimulus Check Isn't Coming—But the Future of Financial Relief Is Closer Than You Think

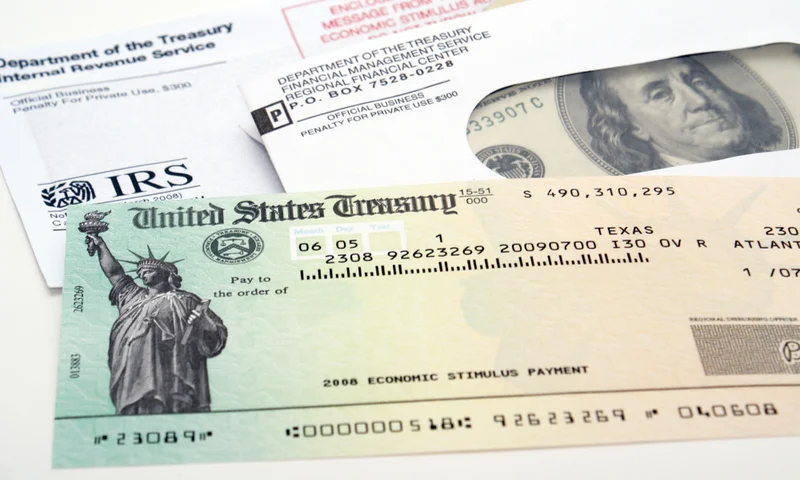

Okay, let's address the elephant in the room: those rumors swirling around about a surprise $2,000 IRS stimulus check landing in everyone's bank account this November? Yeah, unfortunately, that's not happening. I know, I know—disappointing, right? Several sources have debunked these claims, and it's always wise to approach such news with a healthy dose of skepticism. Is a $1,702 stimulus check coming? Latest news on claims of 2025 payments Always double-check with official government websites before getting too excited.

But here's the thing: while that specific scenario is a bust, the idea behind it—the possibility of more direct financial relief for Americans—isn't as far-fetched as you might think. And that's what really excites me.

The Real Story: It's About Innovation, Not Just Handouts

Look, I get it. The headlines are designed to grab your attention. "$2,000 Free Money!" But what's really interesting is the underlying conversation—the increasing demand for innovative solutions to economic challenges, the creative ideas being floated, and the potential for technology to revolutionize how we think about financial assistance.

We’ve seen glimpses of this already. Remember the talk about a "DOGE dividend," using tariff revenue to fund taxpayer rebates? Or Senator Hawley's American Worker Rebate Act? These proposals might not have materialized, but they signal a shift in thinking. People are actively searching for new ways to distribute wealth and provide support. And that’s where the real opportunity lies.

Think about it: the old stimulus checks were a blunt instrument, a necessary response to a crisis. But imagine a future where financial relief is more targeted, more efficient, and more directly tied to the needs of individuals and communities. What if we could leverage technology to create a truly responsive and equitable system? This is the kind of breakthrough that reminds me why I got into this field in the first place.

Now, Rep. Ro Khanna suggested a $2,000 stimulus check for families making under $100,000 a year to offset rising costs due to tariffs. While that specific proposal is still just that—a proposal—it highlights a crucial point: the need to address economic disparities and provide relief to those who need it most.

The state-level initiatives are also worth noting. Inflation relief checks in states like New York, Pennsylvania, and Colorado are examples of how targeted assistance can make a real difference. And New Jersey's ANCHOR property tax relief program? These are all steps in the right direction.

But here's the question I keep asking myself: How can we scale these localized efforts and create a nationwide system that's both effective and sustainable? How do we ensure that these programs are reaching the people who need them most, without getting bogged down in bureaucracy or vulnerable to fraud?

That, my friends, is the trillion-dollar question.

The IRS "Where’s My Refund" tool is a basic example of how technology can provide transparency and track the status of payments. But we can do so much better. Imagine a system where individuals can easily access information about available benefits, track their eligibility in real-time, and receive payments directly and securely through a blockchain-based platform. (Blockchain – in simpler terms, a secure and transparent digital ledger).

This isn't just about faster payments; it's about building trust and empowering individuals to take control of their financial well-being. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend.

It reminds me of the early days of the internet. Remember when people were skeptical about online banking or e-commerce? Now, they're integral parts of our daily lives. I believe we're on the cusp of a similar transformation in the realm of financial assistance.

Of course, with any new technology, there are ethical considerations. We need to ensure that these systems are secure, equitable, and accessible to all, regardless of their technical expertise. We need to guard against bias and discrimination and protect individual privacy. But these challenges are not insurmountable. With careful planning and thoughtful design, we can create a system that benefits everyone.

The key is to shift our focus from simply reacting to crises to proactively building a more resilient and equitable financial future. We need to embrace innovation, experiment with new approaches, and learn from our successes and failures.

The Dawn of a New Economic Era

So, no, that $2,000 stimulus check isn't coming this November. But the future of financial relief? It's closer than you think.

Tags: irs stimulus checks 2025

When is Election Day?: What We Know – What Reddit is Saying

Next PostNovember 2025 Calendar: Thanksgiving, Veterans Day...and What Else?

Related Articles