Medicare 2026 Premiums: Decoding the Future of Part B, Income Brackets, and Social Security's Next Chapter

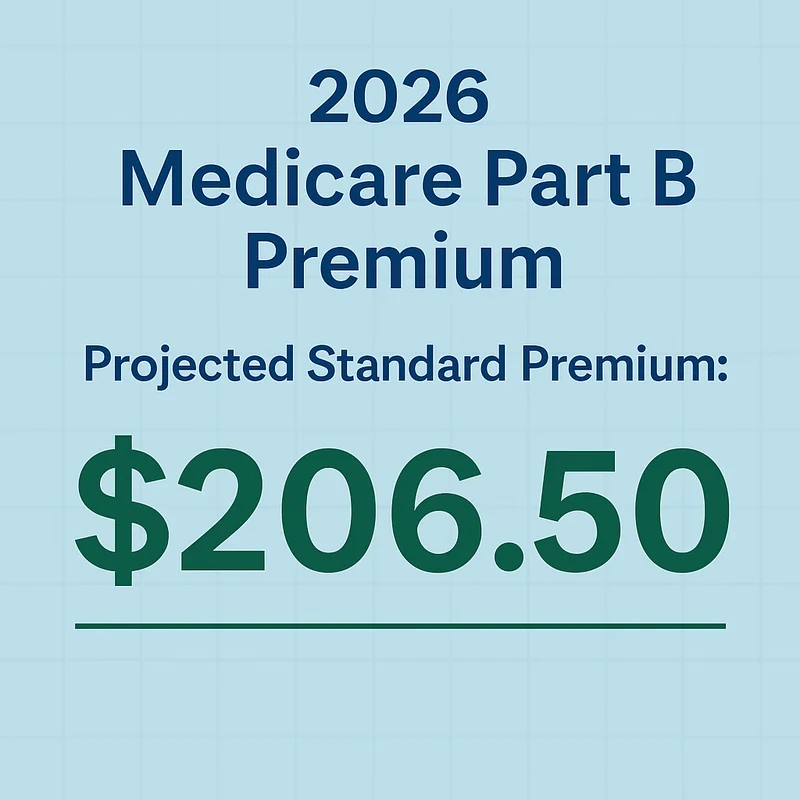

The Centers for Medicare and Medicaid Services (CMS) just dropped their numbers for 2026, and if you’re a Medicare beneficiary, you’ve probably already felt that familiar knot tighten in your stomach. The headline everyone's talking about? A nearly 10% jump in standard Medicare Part B monthly premiums, hitting $202.90. That's a $17.90 increase, making it the largest in four years and the second-largest in dollar terms since the program began. This significant increase is highlighted by Senior citizens will pay a lot more for Medicare in 2026 - CNN. But here’s the rub, and this is where the raw data starts to tell a more nuanced, and frankly, more concerning story than the official press releases would have you believe.

Imagine you're at a poker table, and the dealer just pushed a significant portion of your chips to the house before you even saw your cards. That's essentially what's happening for millions of seniors. The average Social Security cost-of-living adjustment (COLA) for 2026 is set at a modest 2.8%, translating to about $56 a month. That Part B premium hike will eat up nearly one-third of that increase. This impact on beneficiaries is further explored in Medicare premium increase reduces Social Security COLA for 2026 - USA Today. For most, that means an actual net gain of around $38 a month. Fine, you might think, a gain is a gain. But for lower-income Social Security beneficiaries, say someone pulling in $600 a month, their 2.8% COLA is a paltry $16.80. That's less than the Part B premium increase. The "hold harmless" provision will protect those folks from seeing their benefit check shrink, limiting their Part B premium increase to the dollar amount of their COLA. It’s a mechanism designed to prevent an outright reduction in benefits, which is good, I suppose, but it certainly doesn't help them get ahead. It’s a partial shield, not a path to improved financial standing. And for those with higher adjusted gross incomes (over $109,000 for a single person, $218,000 for a married couple), the 2026 IRMAA brackets mean you’re paying even more than that $202.90. The system, it appears, is designed to take its cut, no matter where you stand.

The Squeeze on Your Social Security Check

Let's be precise about this erosion. The official line from CMS Administrator Dr. Mehmet Oz is that "Millions of Medicare beneficiaries will continue to have access to a broad range of affordable coverage options in 2026." Now, I've looked at hundreds of these statements, and this particular phrasing always raises a red flag. "A broad range" isn't the same as "an expanding range," nor is "affordable" the same as "more affordable." The data, as always, paints a clearer picture. The drivers are familiar: rising medical and pharmaceutical costs, increased usage, and the ongoing enrollment of baby boomers shifting towards outpatient services (which Part B covers, unlike Part A for hospital services). Even with CMS reducing potential premium increases by $11 through a change in skin substitute payments (a category that ballooned from $256 million in 2019 to over $10 billion last year—a staggering 3,800% increase), the fundamental trajectory remains upward for the beneficiary.

My analysis suggests that while the Part D prescription drug policies are seeing "modest changes"—some insurers hiking premiums by up to $50, others holding steady—the real story for many is playing out in the Medicare Advantage (MA) market. This is where the narrative of "broad options" starts to fray under the weight of the numbers.

The Shrinking Map of Medicare Advantage

For the second consecutive year, the MA market is contracting. The number of offerings is tumbling by 10% to 3,373 plans for 2026. Major insurers like CVS Aetna, Elevance, Humana, and UnitedHealthcare are actively reducing their MA plan options in at least 100 counties, impacting over 2 million people. And this isn't just a slight trim around the edges. In a significant development, some Americans in specific counties—eight in Vermont, for example, due to Blue Cross and Blue Shield of Vermont and UnitedHealthcare discontinuing coverage—will wake up to no Medicare Advantage plans available. None. This isn't a "broad range"; it's a desert.

While most Medicare beneficiaries will still have an average of 39 MA plans in 2026 (down from 42), that average can be a statistical mirage. It's like saying the average person has one testicle and one ovary; it's numerically true but clinically meaningless. The local realities are what matter. Fewer MA plans will offer $0 deductibles for prescription drugs, and maximum out-of-pocket limits for medical care are rising by an average of $490, a roughly 10% increase. The average premium for MA plans with drug coverage will also increase to $66 next year, up from $60. And those supplemental benefits, often touted as a key advantage of MA? They’re getting skimpier. The average dental allowance, for instance, is declining 10% to $2,107. It's like a buffet where the main dishes are getting pricier, and the dessert bar is slowly being replaced with fruit cups.

This is the part of the report that I find genuinely puzzling: the official narrative persists that beneficiaries have "access to a broad range of affordable coverage options" when the data clearly indicates a contraction of choice and an increase in costs for many. It's a classic case of official pronouncements being divorced from ground-level realities. The market, it seems, is consolidating and recalibrating, and the beneficiaries are paying the price, both in dollars and in diminished options.

The Inevitable Squeeze

The data is clear. While the CMS managed to slightly undercut earlier trustee projections for Part B premiums, the fact remains that 2026 is shaping up to be a year of increasing costs and decreasing options for many Medicare beneficiaries, especially those relying on Medicare Advantage. The "broad range of affordable coverage options" is, for a significant segment of the population, a shrinking horizon. It’s a slow, steady erosion of value, masked by averages and softened by rhetoric. For a population on fixed incomes, even small percentage shifts in core expenses represent a substantial impact. The numbers don't lie; they simply wait for someone to interpret them without the filter of official optimism.

Tags: medicare 2026 premiums

Verizon Layoffs: The CEO's Mandate, 2025 Projections – What Reddit is Saying

Next PostGOOG Stock: The 'Missed AI' Narrative and What You're Not Being Told

Related Articles