PFE Stock: Is it a buy, or just more hype?

Alright, let's talk about Pfizer. Because apparently, someone out there thinks there's an "incredible reason" to buy this stock. And honestly, after sifting through the usual corporate-speak, I gotta say... they're really trying to sell us a dream that looks more like a slightly tarnished, heavily discounted reality.

The "Incredible" Yield: Or, Why Your Discount Bin Find Isn't Gold

So, the big hook, the "incredible reason" they're dangling like some shiny lure? A whopping 7% dividend yield. Seven percent! That sounds pretty sweet, right? Especially when your high-yield savings account is coughing up, what, 4-5%? Yeah, for now. And they're quick to point out that if interest rates dip, your savings account's pittance will shrink, while "healthy and growing dividend payers tend to increase their dividends over time." Tend to. That's a fun word, ain't it?

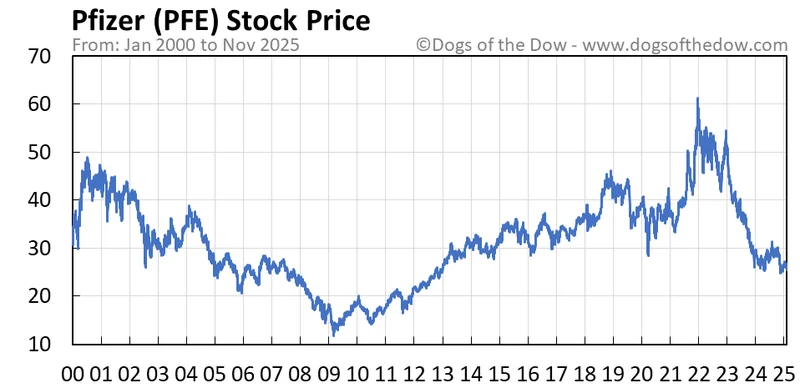

Let's be real for a second. When something's offering you that kind of yield, you gotta ask why. It's like finding a brand-new luxury car selling for pennies on the dollar. You don't immediately think, "Wow, what a steal!" You think, "What's wrong with it? Is it haunted? Is the engine full of squirrels?" And in Pfizer's case, the answer is plastered right there, barely hidden under the gloss: the stock price has fallen. Hard. Like, down more than 35% over the past three years while the S&P 500 was busy doing a victory lap, up 84%.

So, that "incredible" 7% yield? It's not because Pfizer's business is suddenly booming like a forgotten oil well. It's because the stock has taken a beating. It’s like getting a massive discount at a store that’s going out of business – yeah, the price is great, but what does it say about the future? Are we supposed to just ignore the fact that the company's value has been eroding while its peers soared? I mean, come on...

The COVID Hangover and the Acquisition Gamble

Now, why the big drop? Oh, you know, just the global pandemic winding down, that small thing. Pfizer’s business absolutely exploded in the early days, everyone scrambling for their vaccine and Paxlovid. But surprise, surprise, demand for pandemic-era drugs tends to drop when the pandemic... well, becomes endemic. Who would've thought? It's like building an entire empire on fidget spinners and then wondering why sales are down when everyone moves on to the next shiny distraction.

But hey, they've got a pipeline! A bunch of drugs in development, some of which may turn out to be blockbusters. "May" is another one of those words I love, it gives me such confidence. It’s like my mechanic telling me my car may run after he tinkers with it for another five hours. It's not a promise, it's a prayer.

And here's where it gets really spicy, where the "incredible reason" starts looking less like a golden ticket and more like a potential trap. Pfizer's a serial acquirer. They bought Wyeth in the past, and what happened? They trimmed their dividend. Cut it. Now they're buying Metsera, a weight-loss drug developer. And 1 Incredible Reason to Buy Pfizer Stock (PFE) in November, in its infinite wisdom, gently warns that this could lead to another dividend cut. Might not happen, they say. And even if it does, it'll still yield a "respectable" 3.5%. Respectable? We just got done talking about 7%! That's like being promised a steak dinner and ending up with a half-eaten hot dog. I'm not saying it's a bad move for the company long-term, but it sure as hell ain't an "incredible reason" to buy the stock right now if your whole premise is the dividend.

This whole situation feels like being invited to a fancy dinner party, only to find out the host might just serve you tap water and stale crackers, but hey, the potential for a great meal is always there! And then they ask you for a donation for the privilege. It's a real head-scratcher, offcourse.

Patience, P/E, and the Elephant in the Room

So, we've got a company with a slumping stock, a high dividend yield that's high because of the slump, a history of cutting dividends after acquisitions, and a future that hinges on "maybes." But don't worry, they say, it's trading at a "fairly low valuation" with a forward P/E of 8, well below its five-year average of 10. And both those numbers are "on the low side." Yeah, low for a reason, buddy. Usually, when something's cheap, there's a reason it's cheap. It's not always a hidden gem; sometimes, it's just... cheap.

"If you're patient and prepared to keep an eye on the company's developments, you can probably collect a hefty dividend over many years to come." Patience. That's what they always say when they want you to sit still while the market moves on without you. Maybe I'm just too cynical, but when I see a headline screaming "incredible reason" and then the fine print is basically "yeah, but also, maybe not, and you'll need the patience of a saint," my B.S. detector starts wailing like a banshee.

Then again, maybe I'm the crazy one here. Maybe the allure of that big, fat 7% is enough to overlook everything else. But I doubt it. The Motley Fool's own analysts, the same folks who put out 1 Incredible Reason to Buy Pfizer Stock (PFE) in November, didn't even put Pfizer in their top 10 stocks to buy right now. Think about that for a second. Your own team can't even stand behind it, but you're gonna tell me it's an "incredible reason"? Give me a break.

Don't Fall for the Dividend Trap

Look, if you want to invest in Pfizer because you believe in their long-term pipeline, or you're a true believer in big pharma, go for it. But to hang your hat on that 7% dividend yield as the incredible reason? That's just naive. It's a high yield born of desperation and a slumping stock price, with a very real threat of being cut. It's bait, pure and simple. And there are better fish in the sea than one that might just swallow your line and then spit out half your bait.

Tags: pfe stock

The IRS's $80 Billion Funding: What the Data Says About New Agents and Your Audit Risk

Next PostLaura Ingraham: Another Day, Another Outrage?

Related Articles